The State of Contractor Management in the Mining Industry

140 Mining Executives Give an Inside Look Into Their Operation

Executive summary

Despite uncertainties that have come with the economic fallout from the global COVID-19 health crisis, the mining industry so far has largely weathered the storm. Although well-positioned, the industry is still in need of solutions for issues of inefficiency that persist throughout the contractor-company relationship. MCi surveyed top executives from 140 mining companies to shed some light on the highs and lows of contractor management in the mining industry. Our goal was to demonstrate how resolving inefficiencies will better position mining organizations to prosper in any economic environment.

The State of Contractor Management in the Mining Industry takes an effective and methodical approach to identify the top pain points, beyond safety, using data from companies surveyed. Our research confirmed that the more contractors a company manages, the more challenges they face, such as additional cost, controlling issues like having the proper skill mix to get the job done, managing variations on agreement terms, and keeping project timelines on schedule.

In analyzing our survey data, MCi found that:

- 60% of surveyed companies reported projects being behind schedule and over budget

- Enterprise-wide contractor spend is upward of $1 billion per year for 11% of companies

- Nearly 90% of respondents are using manual spreadsheets to track project metrics such as completion, productivity, budget, and timeliness

Industry 4.0 (Fourth Industrial Revolution) brings further advanced technology to the mining industry – and it’s here on our doorstep. Staying competitive means adopting digital tools to reduce manual processes and promote more accurate spending and allocating of time and resources. The Fourth Industrial Revolution signals a transition to the digitization of industry – a new level of connectivity and intelligence that seeks to improve industrial processes. For the sake of continuous process improvement and to stay ahead of the game, mining companies are encouraged to take advantage of digital tools to reduce their costs and make contractor management more efficient, and more transparent. In doing so, companies reduce bottleneck, more accurately control spending, and increase successful project results.

In this report, we break down the survey results collected from 140 mining companies to shed light on an apparent disconnect between how companies perceive their contractor management — and reality. By revealing how these perceptions do not always reflect the hard data, we can better serve current and future clients by offering automated solutions that save mining companies millions of dollars and prime them for the industry’s digital transformation.

Introduction

Despite the weaker and less certain global economy, the mining industry is still strongly positioned. According to Mine 2020, PwC’s 17th annual review of global trends in the mining industry, the top 40 mining companies remain financially strong, with flat EBITDA and revenue up 4% to $692 billion, and Capex up 11% to $61 billion worldwide. Although PwC forecasts capital spend to drop overall by the end of 2020, solid financial performance and capital discipline in 2019 has left mining well-positioned in the wake of economic contraction.

Many miners, some for the first time, are experiencing the downside of global supply chains, ultra-lean operations and specialisation. But the pandemic is also highlighting the sector’s resilience and the role that miners play in supporting communities and the broader economy. – Mine 2020, PwC

In the United States, the mining sector’s market share is $396 billion according to IBISWorld, and it employs more than 569,000 industry workers. Although it’s seen a higher level of disruption due to COVID-19—especially in iron ore, coal, and construction materials based on a July 2020 McKinsey & Company report, the U.S. remains focused, as do its peers, on workforce planning as a top priority.

38% of respondents mentioned that their highest priority is workforce and mine planning. -“MineLens survey confirms the significant impact of COVID-19 on mining operations,” McKinsey & Company, July 2020

Management Controls (MCi) assessed companies’ approaches to the contractor segment of the mining workforce to shed light on critical pain points throughout the owner/ contractor relationship including safety, cost leakage, and worker efficiency.

Methodology

MCi developed a survey for mining companies designed to identify and bring focus to key pain points around managing contractors and contractor spend. We developed a short but pointed survey to paint an objective picture for us, help us further explore the market, and illustrate how we can help solve common contractor management problems.

Our survey was created in Survey Sparrow and Survey Monkey, well-respected and user-friendly formats we could easily promote digitally. MCi then reached out to mining companies via email, as well as online through mining.com and miningreview.net. We far exceeded our goal of 50 respondents with more than 140 survey participants, each imparting critical industry insights for us to analyze and ultimately, help resolve.

Participants were welcome to complete the survey at their own pace in a pressure-free environment. Each question was designed to address issues of budget, efficiency, safety, workforce visibility, skill mix, and control over contractor materials, equipment, and labor. The answers allowed us to gauge correlations between contractor spend and the greatest challenges facing mining companies’ contractor relationships in the current economy.

By weighing the pain points from least to greatest and enabling respondents to write in their own issues if needed, MCi was able to identify mining companies’ most pressing contractor challenges, as well as the need for streamlined digital contractor management solutions.

Results

How many companies are managing 100 or more contractors?

At the root of our analysis is the high volume of contractors that mining companies manage every day. Almost half (45%) of the companies surveyed manage 100 or more contractors at their site. That breakdown includes 25% of companies who manage 100 or more contractors, with nearly 20% of companies who manage 200 or more contractors.

With each contractor relationship, companies inevitably spend more, manage more agreements, and evaluate more variations as project scope creeps out of its initial bounds.

Balancing contractor cost, quality, and efficiency to keep workflows running smoothly and balance sheets healthy can be a massive challenge when working with hundreds of contractor companies. It requires building relationships, tracking expenditures, and having visibility into the effectiveness of the contractor workforce. Spreadsheets simply can’t capture the complexity of many contractor relationships on a granular level. Each contractor has multiple agreements, and each agreement has many different terms and conditions.

Labor spend constitutes around 35-40% of the direct mining cost. – Contract Mining Services Market Intelligence, Beroe

What’s the cost to manage that many contractors?

When it comes to assessing contractor spend, we began by evaluating three high-level metrics. We asked survey respondents to estimate annual contractor spend (including labor, equipment, and materials), total contractor spend (across their entire enterprise), and how they expected that spend to move over the next 12 months.

15.3% of our respondents reported spending more than $100 million per year on contractor management, with a full 23.5% spending $50 million or more—and that’s just at their site. Reining in spend and exerting capital discipline is a must for these companies, who could benefit from tighter contractor management controls and better visibility into every vendor relationship.

15.3% of our respondents reporting spending more than $100 million per year on contractor management, with a full 23.5% spending $50 million or more at just one site.

Enterprise-wide, contractor spend skyrocketed, with nearly 11% of surveyed companies spending upward of $1 billion per year. To put that into perspective, the industry’s global revenue for 2019, the latest year available, was $692 billion in total.

When we asked those surveyed for their outlook on whether contractor spending would increase, decrease, or stay flat over the next year, we received much more evenly distributed data.

With the advent of COVID-19, that 15.3% is notable as a potential bellwether for the industry. Shutdowns and delays mean a backlog of work and more contractors needed to support it.

A quickly growing need for contract support to complete projects put on hold could galvanize companies who’ve traditionally felt confident about timelines and budgets— overwhelming them with new agreements, equipment, approvals, and ultimately, overspending (cost leakage).

Key contractor management pain points in mining

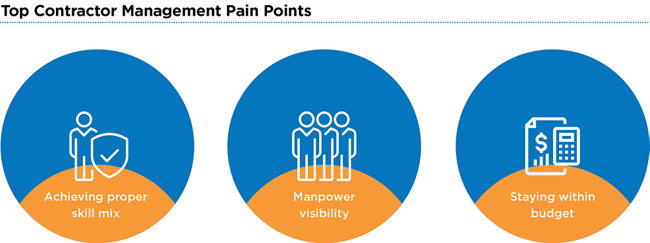

Our survey next sought to identify key pain points for mining companies when it comes to contractor management. We had each survey participant rank seven pain points from the most to least challenging:

- Maintenance scheduling

- Achieving proper skill mix

- Manpower visibility

- Permit process

- Available workforce

- Staying within budget

- Timeliness

Analyzing the matrix of results, we found patterns among these pain points regardless of business size or spend. Overall, the top three challenges were achieving the proper skill mix, manpower visibility, and staying within budget.

A separate study found that more than four out of five mining projects come in late and over budget, by an average of 43%. – “

Getting big mining projects right: Lessons from (and for) the industry,” McKinsey & Company

Digging deeper into this feedback, we examined how results broke down across rankings for the first, second, and third most prevalent pain points.

Finding the right skills for the project, staying on schedule and within budget are key goals across the board. A lack of visibility into skill mix inevitably causes conflict with meeting timeliness and cost, as companies spin their wheels without progressing efficiently. It also presents liability issues such as when a laborer is working at a site above their skill level and the added costs associated with unapproved skill step-ups.

Key procurement department challenges

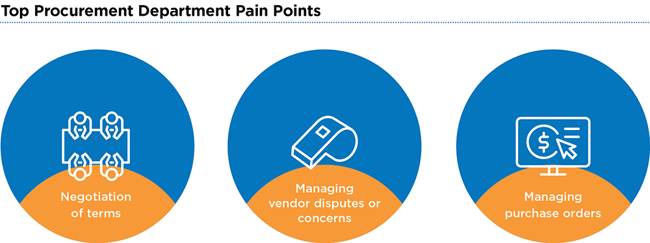

We asked survey respondents to use the same methodology to identify procurement department challenges as they used to rank contract management pain points.

- Variation in agreement terms

- Managing vendor disputes/concerns

- Vendor insurance, certifications, etc.

- Negotiation of terms

- Managing purchase orders

- Vendor audits

At a high level, results suggest that the top 3 challenges for procurement departments include negotiation of terms, managing vendor disputes or concerns, and managing purchase orders.

One of the biggest challenges in today’s mining sites is that despite technological advances, critical data (such as cost and schedule metrics) reside in separate systems that don’t communicate. A comprehensive dashboard that aggregates and analyzes data can give management teams the intelligence they need when they need it. – “Getting big mining projects right: Lessons from (and for) the industry,” McKinsey & Company

Analyzing the matrix of results on a more granular level, we examined how the first-, second-, and third-ranked pain points broke down individually.

It’s easy to see how the top three pain points separated themselves from the rest of the data—all of the most highly ranked challenges for procurement departments correlate to staying on budget. Managing disputes is clearly a concern and something that spreadsheet-based tracking doesn’t solve quickly or accurately. A contractor management system with compliance built in can be a game-changer, automatically ensuring the work performed is under contract.

How many companies are working behind schedule?

The final segment of our survey focused on mining company budgets, project metrics, and tracking. While the vast majority of respondents were aware of their on-time/under budget rate, it’s worth noting that 23% were not. That’s almost one-quarter of surveyed companies being unaware of how many projects lag behind or burst budgets.

60% of surveyed companies reported projects being behind schedule and over budget

We asked respondents to estimate what percentage of their mining projects are completed on time and/or under budget. As a result, research found that a troubling 60% of surveyed companies reported projects working behind schedule and over budget—clear evidence that tightening contractor visibility would improve project completion times and cost.

Questioning the accuracy of the reporting here is also fair game. We assume our survey respondents are answering honestly—that’s not in question. But what if their reporting is fed by flawed data? If a contractor management system isn’t accurate, it can derail billing and tracking. For instance, if a company is getting overbilled and using that overage billing to track, that tracking won’t be accurate.

Our final survey segment concerned how mining companies are currently tracking project metrics, including completion, productivity, budget, and timeliness. A significant majority, 63.6% of those who answered, named Excel® spreadsheets as their primary tracking tool, with another 26.3% using a similar spreadsheet program. That means 89.9% of the companies we surveyed are investing a lot of time in manual data processing, and only 11% using some type of digital platform.

In the mining sector, as in most other industries, the future of work is expected to look very different than it does today. Automation, analytics, and artificial intelligence (AI) are not simply reallocating work between humans and machines. They are also generating greater insights into employee productivity and efficiency. – “Trend 9: Leadership in an Industry 4.0 world: Preparing to manage the mining workforce of the future,” Deloitte Insights

At a time when a great digital transformation is underway within the energy and manufacturing sectors on the heels of Industry 4.0, it’s clear that mining could strengthen its position by adopting more streamlined digital systems for contractor and project management.

Conclusion

After surveying 140 mining companies, it’s evident that contractor management bears room for improvement—especially where budgets and timelines are concerned. Yet 84% of our survey respondents claimed they are satisfied with their current contractor management system. With 60% of them also reporting projects that are behind schedule or overflowing in cost, there’s a discrepancy between the perception of how things are running and the reality behind the hard data. To stay competitive, mining companies need a digital solution for increasing visibility, reducing the manual process, and for monitoring spending on projects.

Powerful digital tools like the TRACK® Platform from MCi eliminate the need for spreadsheets and introduce automated processes to control, manage, and reduce contractor labor, equipment, and materials spend. With real-time visibility into daily operations and built-in contract compliance, TRACK streamlines business processes that increase productivity and reduce cost. Mining companies already using TRACK in their daily operations achieve up to 10-15% in annual savings while tightening controls over labor, equipment, and materials spending across the board. TRACK has also helped mining companies to increase site safety through real-time fatigue monitoring and alerting when contractors exceed their fatigue thresholds.

What is the TRACK® Platform?

TRACK® Platform is a contractor management solution that helps companies automate their processes and gain oversight into their spending and record keeping. A few feature highlights include but are not limited to:

- Reduce delays in productivity with oversight, including proper skill-mix evaluation

- Prevent overspending with the ability to calculate and manage budgets electronically

- Increase contractor visibility – manpower, maintenance and scheduling in real time

- Standardize and manage contracts, including variation in agreement terms

- Gain insight for favorable negotiations

- Manage purchase orders integrated with Enterprise Resource Planning (ERP) systems

- Deliver pre-audited hours and costs for auditors

- Run accurate budget reports using real-time information

Sources

https://www.ibisworld.com/united-states/market-research-reports/mining-sector/

https://nma.org/category/statistics/

https://www.pwc.com/gx/en/energy-utilities-mining/publications/pdf/pwc-mine-2020.pdf

https://www.beroeinc.com/category-intelligence/contract-mining-services-market/

https://www.miningglobal.com/supply-chain-and-operations/mining-procurement-3-trends-you-need-know

https://www2.deloitte.com/us/en/insights.html

https://www.statista.com/statistics/726601/leading-united-states-mining-companies-based-on-revenue/

Without TRACK®, you are operating in the dark. With TRACK, you actually know what your contractors have earned and you work with confidence that you are really paying for what you should be paying for.

Vice President Maintenance and Manufacturing

Want to see TRACK in action?

To learn more about how TRACK can improve contractor management for your mining operation, fill out the form to request a demo.